Deducting Face Masks and Home Office Costs from Your Taxes

What can you deduct from your taxes due to the coronavirus pandemic:

1. Face Mask

You can claim tax deduction over face masks used on public transport or at work when not provided by the employer. The tax deduction is €2 per day for each day when you have travelled between your home and work after 13 August 2020, when the Finnish Institute for Health and Welfare recommended wearing face masks when riding public transit. Claim as a commuting expense to max €750.

2. Remote working

A. Workspace deductions

This deduction is based on the number of days you worked remotely. It covers rent for the workspace and cost of its furniture, electricity, lightning, heating, and cleaning. It can be claimed even if your employer has an office available for you.

Working from home more than 50% of total number of work days = €900

Working from home less than 50% of total number of work days = €450

Occasionally working from home = €225

B. Actual expenses

If you deduct the actual expenses, you must be prepared to specify your claim and present receipts!

C. Work tools such as monitor, keyboard, etc.

If you pay less than €1,000 / tool, claim the expenses in one go during the year of purchase.

If you pay more than €1,000, deduct 25% of the cost every year as depreciation.

D. Data connection

If you are paying for data connection yourself, you can deduct it as expenses for the production of income.

The deductible amount is:

50% of the data connection fees, if you use the connection partly for work

100% of the data connection fees, if you use the connection mainly for work

NOTE: You have to provide receipts only if you are deducting actual expenses (B), the rest is deductible without receipts.

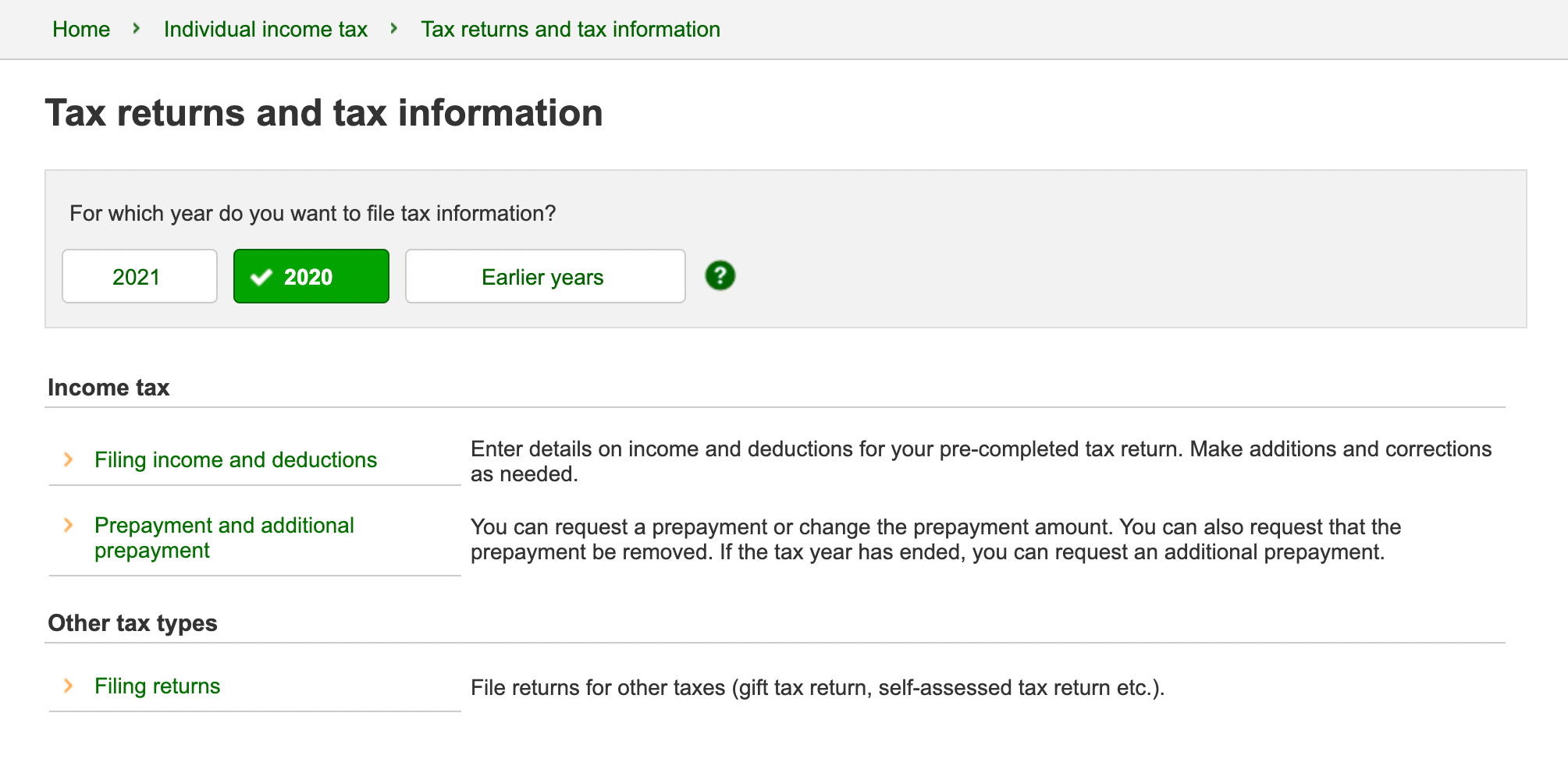

How to deduct your taxes?

It is super easy! Go to vero.fi and log in to your MyTax with your ID initials via bank. In case you don't have this "super power" you can simply call or fill in a paper form and send it via post.

The forms online/offline and super clear, and the only extra job you have to do is to properly count the amount of days you travelled to work in case you are claiming the deduction for the face masks.

Use the picture below to navigate through MyTax. You can get to the deduction page by clicking on - Individual income tax - Tax returns and tax information - 2020 - Filing income and deductions.

Good luck!